As we launched into 2015 I noticed an increase in enquiries through the website from investors wanting to take action in their property business in 2015, the New Year’s resolutions were set!

One such person who made contact was a lady called Catherine Morgan. Catherine had read many of my blogs over the Christmas period and then phoned the office in early January. Since we first spoke Catherine has come into visit us, viewed numerous properties and has already secured a new buy to let property. Now that is what I call taking action!

I speak to many people who sound very keen to get going with property but then they drift off and never take any action, life is so busy and time is tight for everyone but to achieve in any business including a property business you have to just go for it and that is exactly what Catherine has done. Catherine’s action reminded me of Jay and I back in 2008, we decided we were going to get going in property so we just got on with it.

Interview with Catherine Morgan

I wanted to feature Catherine in a bit more detail, so she can inspire you to take action and start building your portfolio.

CP: Tell me a little bit about your background in property?

CM: I have always had an interest in property but never really had a proper strategy.

My ex husband and I purchased 3 investment properties together which included an apartment in London, a small house in North Yorkshire and a holiday rental in Switzerland. All three properties were bought in accordance with what was happening in our life at that time, rather than looking forward to the future and though we did well on capital gains on the London property and had some lovely holidays in the Alps, none of the properties really provided a secure and on-going income for retirement.

CP: You kick started 2015 with a search to build a buy to let property in the Tameside area, what prompted you to take such action now?

CM: I am a yoga teacher and I love what I do.

However, the income I derive from this isn’t enough for me and my family to live on and I didn’t want to take on any work that would significantly diminish my hours dedicated to yoga and teaching. I am recently divorced and I didn’t want to see the proceeds of my settlement disappear on living costs with nothing left for retirement so I spent a few weeks looking at where the best yields in the country were to be found on rental properties.

Manchester seemed to be an obvious choice with the second highest yields in the country and right on my doorstep and I am quite familiar with areas to the east of the city due to regular trips to the yoga institute in Dukinfield. Some further googling brought me to Abode Property Management (NW) Ltd’s website which was packed with information on the area and lots of helpful tips for buy-to-let investors with the particular focus on the area I am looking to invest in. Most other websites I visited just wanted me to spend hundreds or even thousands of pounds on buy to let investment training.

CP: What is your strategy for buying your buy to let properties?

CM: I would like to obtain 5 properties in Manchester within the next 18 months.

I have just had an offer accepted on my first property with another one hopefully following very soon. I am planning to sell a buy to let property I own in North Yorkshire that isn’t performing very well and use the proceeds as a deposit to purchase 3 more properties.

I will do this on interest only mortgages with a 40% deposit initially. This means I can have a larger portfolio from the outset for better yields and potential capital growth across more properties. When I downsize from the family home in the next 5 years I will be able to pay off the mortgages.

Having a 40/60 loan to value ratio means I will already have a small income from the portfolio but once the mortgages are paid off in 5 years time I will have a good additional income to support my teaching income and take me into retirement. If the strategy works I may decide to invest in further properties but don’t want to ‘run before I can walk’ and end up over extending myself.

CP: What are the numbers on the property you have secured this week?

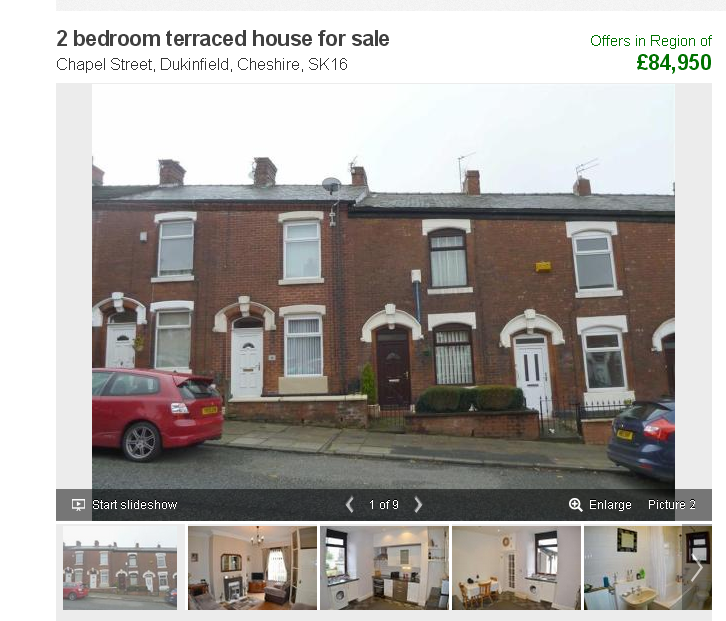

CM: I have just purchased a 2 bed terraced property in Dukinfield, Tameside for £79800 which is almost ready to go (just a little decorating required). Due to the buoyant rental market I am hoping this will rent for £475 per month, a yield of 7.1%. This is a much higher yield than I would expect in my home town of Sheffield.

CP: How have myself and Tracy helped you in your buy to let search and how do you see Abode supporting you as you build your portfolio?

CM: After reading the blogs and information on Abode’s website I decided to give them a call. Charlotte was so helpful from the minute we started chatting and it is clear she just loves property and is happy to share her extensive knowledge.

After seeing a few properties I visited their offices and went through them with Charlotte and Tracy who both offered lots of good suggestions and advice about which properties would rent well. Their knowledge of the areas I am looking at was really valuable and helped me in my search for other better properties which made me feel confident in finally securing my first one.

I will look forward to handing them my first property to manage and am sure that their experience will help me secure good tenants.

The Facts and Figures of Catherine’s first puchase of 2015

Two bedroom mid terraced property

Purchase Price £79,800

Rental Valuation £475

Gross Yield 7.14%

Catherine’s first buy to let purchase of 2015

If you would like to follow in Catherine’s footsteps then have a look at the following blogs that will help you think about the areas you may want to consider.

Then just as Catherine did, give us a call and come and see us. We are happy to advise you on specific properties that you are considering, we know the ins and outs of the local area so we can give you on the ground information about rental figures, the street, the local amenities, the schools.

Exactly the kind of information that you want to know when considering a purchase but is quite difficult to find online. Use our local knowledge and save yourself a heap of time too!

Further Reading

Which area in Manchester to buy investment property? How about Oldham?

Buy to Let in Manchester? Which are the best areas? Let’s look at Tameside.