The best area in Manchester for Buy to Let?

Why you should choose Manchester for your buy to let investments.

My journey into property investing in the Manchester area came about more by chance than a clear decision. Having come to Manchester to study in 2000, I never quite managed to leave the the city after graduating. Roll on 8 years and when my (now) husband and I began looking to invest we realised we were living in one of the best areas for buy to let investment in the country.

Our strategy was to purchase properties below market value for the buy to let market. The areas to the north, west and east of Greater Manchester provide some excellent yields for this strategy and is not only the best area in Manchester for buy to let but make up some of the best areas in the UK as a whole.

As we started our property journey we attended networking events (we now run our own – The Manchester Property Meet) and we met many people who had travelled up from London and other areas further in the South East to learn about Manchester as an area to invest in. We soon realised how fortunate we were to have such a great area for buy to let on our doorstep, other investors were travelling over 200 miles to get a piece of the action!

So why should you choose Manchester as your best area for buy to let?

1. London is not a viable option (unless you have squillions!)

You can buy a property outside of our capital and achieve yields at as much as THREE TIMES AS HIGH!

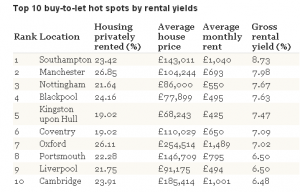

In a recent article written by The Telegraph they have quoted yields from recent figures provided by HSBC in cities outside of London. Southampton tops the list at 8.73%, MANCHESTER is second in the scores with 7.98%, Nottingham, Blackpool and Hull complete the list with figures of 7.67%, 7.63% and 7.47% respectively.

The full list provided by The Telegraph is here:

London may get you fantastic capital gains but if your strategy is to buy and hold property, for your pension for example, then a capital gain, with all its tax liabilities may not be the right the strategy for you. You will need a huge chunk of cash for stamp duty, not to mention a ginormous deposit!

2. Manchester has affordable properties!

One of the major factors that makes Manchester the best area for buy to let is the price of the properties in some of the areas of Greater Manchester. This coupled with the rental prices across the area equals an excellent yield.

Yield is calculated by dividing the annual rental income by the total property cost, in a simple sum, let’s take a property worth £100,000 and the rent of £500 per month, 500 x 12 = £6000 divided by 100,000 = 0.06 x 100 = 6%.

In this series of blogs looking at the specific different locations that make up the best areas for buy to let in Manchester, looking at the house prices and yields in these areas. Have a look at my blog on Tameside for some information on that area.

3. People want to live in Greater Manchester!

There is a total population in Greater Manchester of 2,682,500 and the area has a lot to offer it’s residents. Manchester is the 3rd largest city in the country and it’s city centre has the same stores as London, they are just less spread out! We have football teams galore, not a weekend goes by when some fantastic sporting event is far from our doors! We have great transport links to all areas of the city as well as the rest of the country, which may well be improved further with the development of HS2.

Manchester also has the largest university population in the country, even if you don’t fancy student lets you will get tenants, like myself, who decide that they want to stay in the city after finishing studies. I rented in three different properties after uni for 5 years before buying my own property.

To give you an idea our tenant mix at Abode is made up of working couples, working families with multiple children, young professional couples, young profession foreign couples, families in receipt of housing benefit, couples in receipt of housing benefit who work part time and families in receipt of full housing benefits.

So to sum it up, we have tenants a plenty in Manchester!

Find out more about some of the best areas in Manchester for buy to let.

If you would like to know a bit more about the more specific areas of Manchester that we particularly like and are active investors in, take a look at our series of Location Guides; starting with;

Buy to Let in Manchester – Abode’s Ten Reasons to Buy or Rent in Tameside

Which area in Manchester to buy an investment property? How about Oldham?

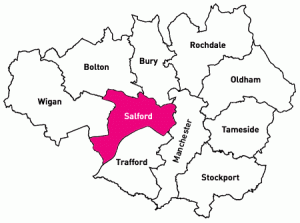

Investing in Manchester – How about looking across the river to Salford?